The better you know your audience, the more easily you can turn prospects into clients.

But most professional services firms don’t know their audiences as well as they should. Nor are they fully aware of the evolving challenges and trends that affect their clients’ businesses. As a result, most service firms—perhaps even yours—are missing out on opportunities to solve the problems that matter most to their clients.

How do you stay abreast of changes in your clients’ marketplace?

What are the Drawbacks?

You might try to sit down with each client on a regular basis and ask about their business challenges. For most busy firms, that just isn’t practical.

A better approach is to establish an ongoing program of structured research in which you contact a representative sample of your market and learn about their problems, successes and how they perceive your firm. The resulting data will suggest ways you can adjust your business to give you an advantage over your competitors.

The Research on Research

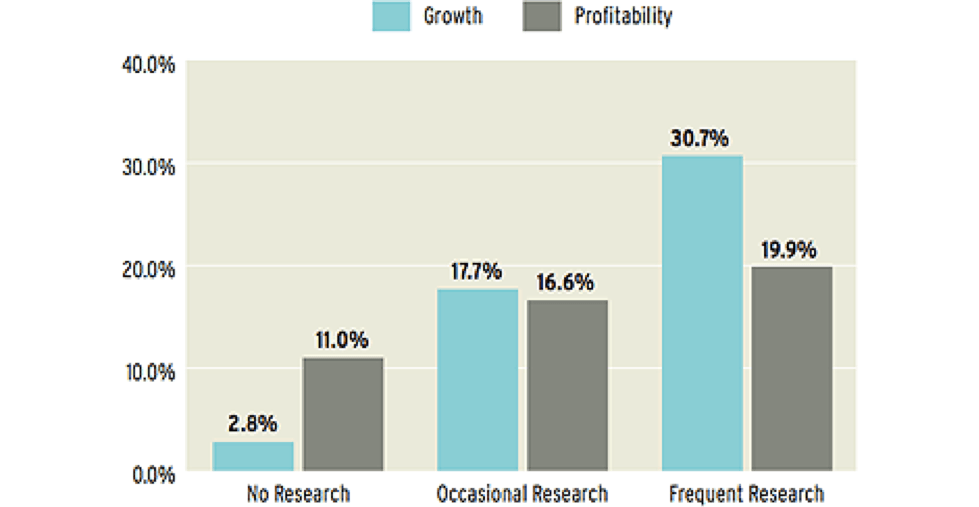

Firms that conduct regular market research tend to grow much faster and are more profitable than their peers that do little or no research. We know from past experience, firms that regularly research their client markets (at least quarterly) grow more than 10 times faster and are almost twice as profitable as firms that do none.

Even doing occasional research can have a tremendous effect on your firm’s growth and profitability, but the greatest gains go to those who make it part of their marketing routine.

How to Conduct Research

Let’s make one thing clear: The kind of research we’re talking about is not a client satisfaction survey. It’s much broader and yields more strategic information.

So what does this research look like? And how do firms conduct it? There are no hard and fast rules, but here are a few guidelines to get you started:

Phone interviews are best. Nothing beats a live interview. Even reluctant participants will open up to a skillful interviewer. In fact, the greatest insights are often volunteered outside the scope of the questionnaire.

Online surveys are second best—but they don’t have to be second rate. An online survey will never capture the same insights as an interview, but a well crafted online survey can still reap valuable information. Surveys also tend to be easier and less expensive to implement. Just remember, your response rate is likely to be very low.

Don’t do it yourself. People are much more likely to provide honest answers to a third party. If you insist on doing the research yourself—which is better than doing no research at all—be aware that you may capture only a portion of the overall picture.

Don’t limit it to your current clients. Cold prospects are more difficult to get on the phone, but they provide—by far—the most accurate picture of your marketplace. Clients who got away offer invaluable insights into your weaknesses. Lapsed clients can similarly help you understand how to become more relevant and engaged.

SEE ALSO: Quality vs. Quantity: A Marketer’s Guide to Brand Research Data Collection

What Questions Should You Ask?

We recommend you include a mix of open-ended and closed questions. Open-ended questions give participants the opportunity to provide detail and volunteer information you may not have anticipated. Closed questions (ratings, multiple choice and yes/no questions) take less time and are easy to tabulate and compare over time.

In the questions themselves, address issues relevant to your clients’ industries. But don’t forget to ask about the bigger picture:

- Key challenges they face in the market

- Their priorities for the coming year

- How they make buying decisions

- How they perceive your firm (strengths, weaknesses)

- What they look for in a firm like yours

- Who they view as your competitors

- Services they need in the short term.

How Many Interviews?

You will want to talk to a reasonable swath of your audience—enough to paint an accurate portrait of your market. We find that 20–30 interviews often provide enough data for most firms, although more is always better. You may be able to get away with a smaller sample, but you run the risk of getting skewed results. Of course, a more diverse target market will require a much larger sample.

How to Use Research

Most firms find many uses for their market research. Here are just a few of the ways you can use your research to enhance your reputation, generate leads and bring in more clients:

- Tweak or redefine your positioning to differentiate your firm from competitors

- Introduce new services that prospects want

- Use it as an entrée to bring former clients back into the fold

- Offer new services to current or former clients

- Anticipate clients’ needs

Most important, you can boost your credibility with your target market and increase your visible expertise by pulling from your research findings to write blog posts and articles that address urgent market challenges, to publish a research study, and as fodder for speeches, seminars or webinars.

Getting Started

As discussed above, using an independent third party will give you the best information. Third-party market research has the added benefit of taking most of the work off your plate, which makes it easy to regularly take the pulse of your market. Our own research suggests that, to make the most of research, you’ll want to conduct research at least quarterly.

If you prefer to conduct the research yourself, make it a priority. Research can mean a great deal of work, especially if you are conducting phone interviews. So build market research into the job descriptions of the people who will do the work.

And speaking of staff…phone interviewing is an art, so you may want to invest in some formal training for your research staff.

Remember, even occasional research is better than none. The sooner you get started, the sooner your firm will reap its rewards.

Additional Resources

- Our Professional Services Guide to Research gives you the tools and knowledge you need to lead your firm through conducting research.

- Dive into Hinge’s own research into what motivates professional services buyers in the free book, Inside the Buyer’s Brain.

How Hinge Can Help

Brand research gets to the core of what will resonate with those audiences—and is an integral part of what Hinge does for clients. Learn more about our research services or contact us to learn whether research makes sense for your professional services firm.