In its recent research, 2022 High Growth Study, the Hinge Research Institute made an eye-opening discovery:

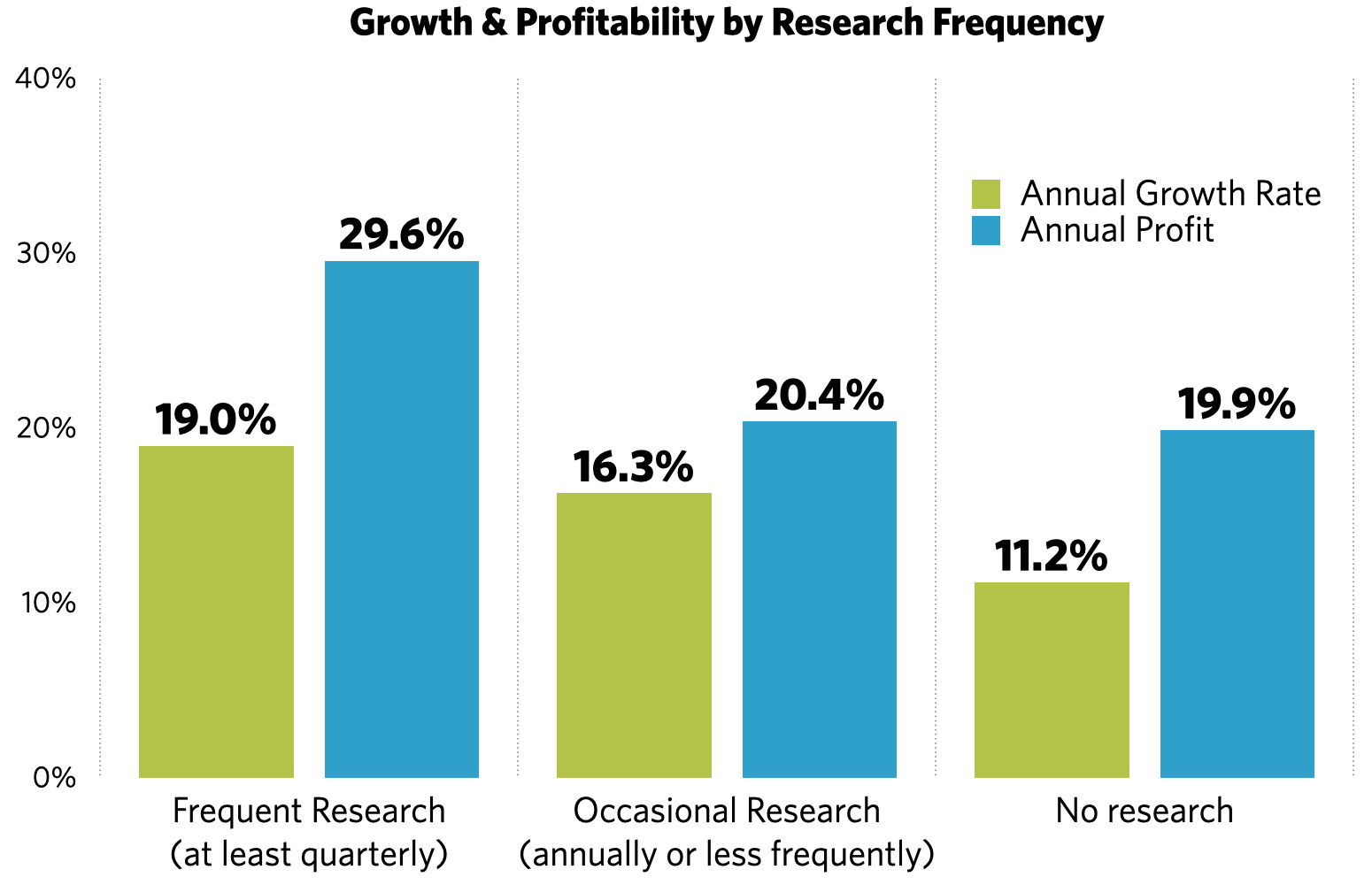

Those professional services firms that did systematic business research on their target client group grew faster and were more profitable than their peers and competitors.

In fact, those that did more frequent business research (at least quarterly), grew the fastest and were most profitable. Additional research also confirms that the fastest growing firms do more research on their target clients.

Think about that for a minute. Faster growth and more profit. It makes you start thinking of research in a different light, doesn’t it?

You may start thinking about what kind of research to do and how it might help grow your firm. We’ve reflected on the kinds of questions we’ve asked when doing research for our professional services clients and how the process has impacted their strategy and financial results. There are a number of types of research that your firm can use, including:

- Brand research

- Persona research

- Market research

- Lost prospect analysis

- Client satisfaction research

- Benchmarking research

- Employee surveys

So those are the types of research, but what are the big questions that you need answers for? We looked across the research we have done on behalf of our clients to isolate the most insightful and impactful areas of inquiry. The result is this list of the top 10 research questions that can drive firm growth and profitability:

1. Why do your best clients choose your firm?

Notice we are focusing on the best clients, not necessarily the average client. Understanding what they find appealing about your firm can help you find others just like them and turn them into your next new client.

2. What are those same clients trying to avoid?

This is the flip side of the first question and offers a valuable perspective. As a practical matter, avoiding being ruled out during the early rounds of a prospect’s selection process is pretty darned important. This is also important in helping shape your business practices and strategy.

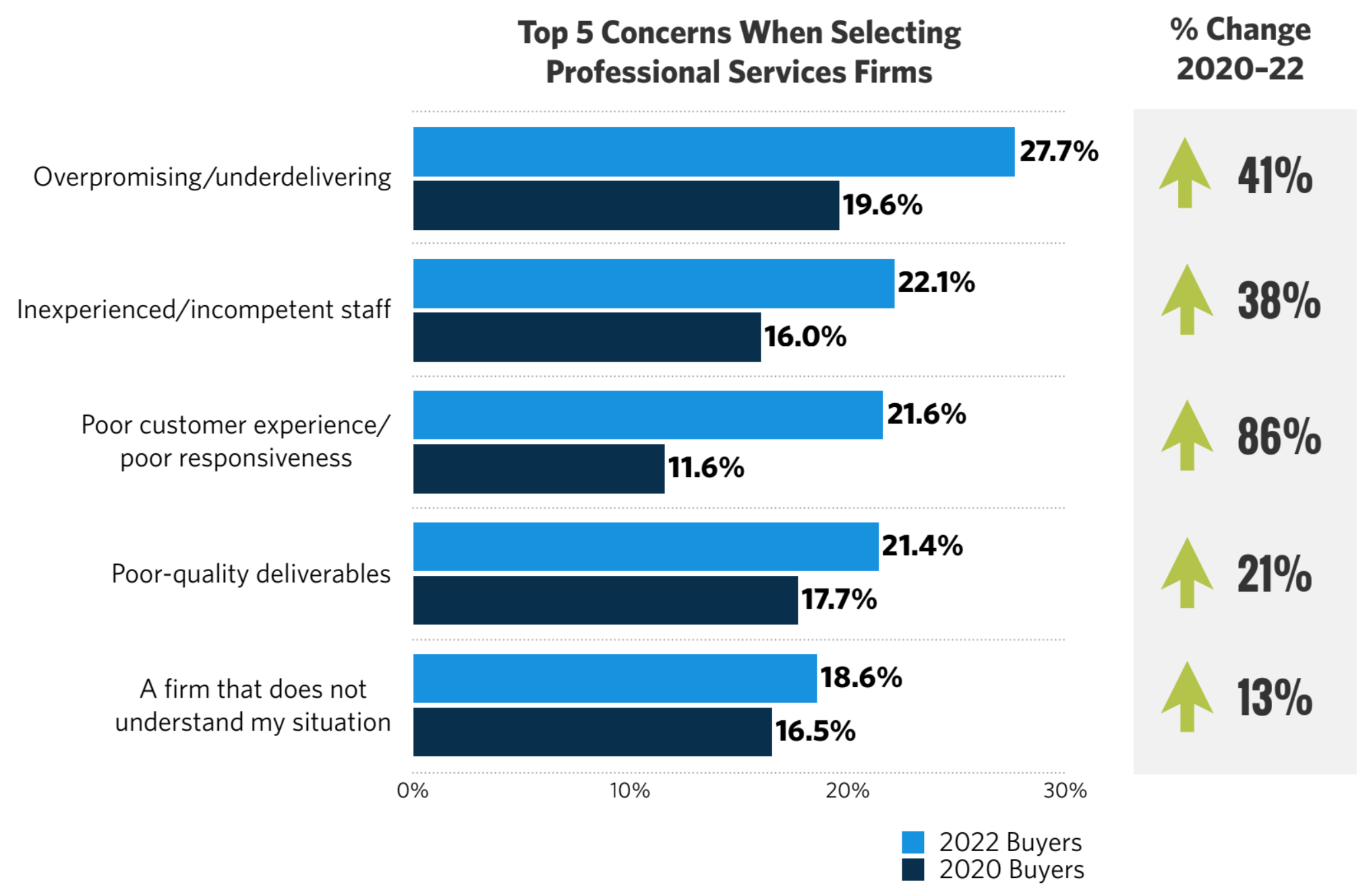

In our research on professional services buyers and sellers, we’ve found that the top circumstances that buyers want to avoid in a service provider are not getting the job done or not being able to solve the problem and overpaying/billing surprises.

We also saw that many sellers misjudged their potential clients’ priorities. Closing this perception gap is one of the ways that research can help a firm grow faster. If you understand how your prospects think you can do a much better job of turning them into clients.

3. Who are your real competitors?

Most firms aren’t very good at identifying their true competitors. When we ask a firm’s staff to list their competitors and ask their clients to do the same, there is often only about a 25% overlap in their lists.

Why? Sometimes, it’s because you know too much about your industry and rule out competitors too easily. At other times, it’s because you are viewing a client’s problems through your filter and overlook completely different categories of solutions that they are considering. For example, a company facing declining sales could easily consider sales training, new product development, or a new marketing campaign. If you consult on new product development the other possible solutions are all competitors. In any case, ignorance of true competitors seldom helps you compete.

4. How do potential clients see their greatest challenges?

The answer to this question helps you understand what is on prospective clients’ minds and how they are likely to describe and talk about those issues. The key here is that you may offer services that can be of great benefit to organizations, but they never consider you because they are thinking about their challenges through a different lens.

They may want cost reduction when you are offering process improvement (which, in fact, reduces cost). Someone needs to connect the dots, or you will miss the opportunity. This is similar to the dilemma of understanding the full range of competitors described with Question 3.

5. What is the real benefit your firm provides?

Sure, you know your services and what they are intended to do for clients. But what do they actually do? Often, firms are surprised to learn the true benefit of their service. What might’ve attracted a client to your firm initially might not be what they end up valuing most when working with you. For example, you might have won the sale based on your good reputation, but after working with you, your client might value your specialized skills and expertise most.

When you understand what true value and benefit of your services, you’re in a position to enhance it or even develop new services with other true benefits.

6. What are emerging trends and challenges?

Where is the market headed? Will it grow or contract? What services might be needed in the future? This is fairly common research fodder in large market-driven industries, but it’s surprisingly rare among professional services firms.

Understanding emerging trends can help you conserve and better target limited marketing dollars. We’ve seen many firms add entire service lines, including new hires and big marketing budgets, based on little more than hunches and anecdotal observations. These decisions should be driven by research and data. Research reduces your risk associated with this type of decision.

7. How strong is your brand?

What is your firm known for? How strong is your reputation? How visible are you in the marketplace? Answers to each of these questions can vary from market to market. Knowing where you stand cannot only guide your overall strategy, it can also have a profound impact on your marketing budget. An understanding of your brand’s strengths and weaknesses can help you understand why you are getting traction in one segment and not another.

8. What is the best way to market to your prime target clients?

Wouldn’t it be nice to know where your target clients go to get recommendations and referrals? Wouldn’t it be great if you knew how they want to be marketed to? These are all questions that can be answered through systematic business research. The answers will greatly reduce the level of spending needed to reach your best clients. This is perhaps one of the key reasons that firms that do regular research are more profitable.

9. How should you price your services?

This is often a huge stumbling block for professional services firms. In our experience, most firms overestimate the role price plays in buying decisions. Perhaps it is because firms are told that the reason they don’t win an engagement is because of price. It is the easiest reason for a buyer to share when providing feedback.

However, if a firm hires an impartial third party to dig deeper into why it loses competitive bids, it often learns that what appears to be price may really be perceived level of expertise, lack of attention to detail or an impression of non-responsiveness. We’ve seen firms lose business because of typos in their proposal — while attributing the loss to their fees.

10. How do your current clients really feel about you?

How likely are clients to refer you to others? What would they change about your firm? How long are they likely to remain a client? These are the kinds of questions that can help you fine-tune your procedures and get a more accurate feel for what the future holds. In some cases, we’ve seen clients reveal previously hidden strengths. In others, they have uncovered important vulnerabilities that need attention.

The tricky part here is that clients are rarely eager to tell you the truth directly. They may want to avoid an uncomfortable situation or are worried that they will make matters worse by sharing their true feelings. That’s why at Hinge, we’ve hired an outsider to conduct research on our own clients, even though research is one of our core services.

Understanding the key questions discussed above can have a positive impact on your firm’s growth and profitability. That is the real power of well-designed and professionally executed business research.

How Hinge Can Help

Even with all of its benefits, custom or primary research can come across as intimidating. The Hinge Research Institute can put you at ease by answering all of your questions around survey design, data collection, analysis, data visualization, report design, timelines, costs, best practices, and more. The Hinge Research Institute can help you answer the top 10 business research questions to help you drive your firm’s growth and profitability. The answers will also help drive your branding, pricing, services, business development, and sales strategies. Contact us today.

Additional Resources

- Our Professional Services Guide to Research gives you the tools and knowledge you need to lead your firm through conducting research.

- Dive into Hinge’s own research into what motivates professional services buyers in the free book, Inside the Buyer’s Brain.

- Bring data-driven marketing to your firm with Hinge University’s step-by-step, in-depth courses.